Patricia von Papstein

For M.

Abstract: Capital is a great material to work with. It immediately responds to the energy you charge it with. A new league of investment talents now discovers money as a tool for sensual wealth creation. They direct their capital into Eros Impact. Investments with an Eros Impact manifest the satisfaction of emotional, aesthetic and cultural desires in our industrial societies.

The author describes how the investment strategy of Eros Impact has been developed and how it cultivates wealth identification and deal selection. The article shows that Eros Impact: revolutionizes our collective approach to luxury and pleasure– identifies sensual appeal in portfolio companies and – enables investors themselves to turn into creators of sensuality. As traditional products prize practicability and quality, here products also “serve” the senses and have soulful rewards.

First the author explains the evolution of investment desires due to changing approaches to Eros and wealth. She shows how investors can use this insight to reflect on their investing objectives and which achievements are connected to Eros Impact

Thereafter, the author explains how Eros Impact works in practice. She outlines how she uses Eros Impact benchmarks to detect a portfolio company’s added value. Later, she pinpoints which kinds of companies are masters of creating Eros Impact and which ones are not.

Looking at our future, the author sees Eros Impact as a spirited benchmark to challenge other practices such as for-profit only investing and impact investing. She predicts that investments with Eros Impact would create a ‘sensual’ economy, with products that appeal to the senses and have soulful rewards, and are ready to compete with investments in traditional and new economic spheres.

I have had responsibility as an investor for some 20 plus years overseeing personal investments, serving as a trustee on family trusts and investing foundation assets for impact. While I enjoy this role and have grown in both my knowledge and sophistication as an investor, more recently, perhaps due to the greater complexities in public markets and challenges for funding in private equity deals, I chose to take some time off and re-evaluate my priorities and interests.

Recently, I was fortunate to be introduced to Patricia von Papstein and her avant garde innovative approaches to investing. I saw how some of my private equity choices were actually closely aligned and chosen because of the “sensualness” of the offering and opportunity. Always attracted to innovation and out of the box possibilities, I have always sought full-spectrum opportunities that matched my desire to bring deep earth nurturing and beauty together. One of my first private equity investments was in nano-structured metals. Not only was I awed by the possible applications and transformative potential, after holding a tube of nano-structured titanium, I was hooked. This investment met my sensualness index – touch, beauty, elegance in delivery and multifaceted applicability. Since this first deal, I have continued to seek out other ventures that matched these priorities. I have made investments in organics, health-enhancing technologies, a water-efficiency measurement device and earth nurturing technologies that promote increased yields and efficiencies. I have sought meaningful pleasure by selecting companies with management teams I liked and wanted to support and that produced product lines that spoke to me both as an end-user and provided me great satisfaction to my wealth stewardship needs psychically, emotionally and financially.

Timothy Karsten

The TDKA Group

2012

Introduction

The emotional challenge we face as investors is to connect ourselves and the companies we invest in to meaningful pleasure and essential luxury. We are called to develop a sovereign approach to both sex and money. My aim is to show the amazing opportunities and marked results that are possible if we direct our capital to let Eros create wealth! The multifaceted figure of Eros encourages us to progress to the next chapter of material, social and cultural wealth creation.

How Does Eros Affect Investment Desires?

After having had painful and pleasurable experiences in many ways of investing money, I realized that my approach to wealth creation, as well as the facet of Eros I want to experience in doing so, influences my investment focus and the way I play with my money. From that point on, I reflected on my investments by using the mental road map presented here.

Currently, I am testing this prototype, a tool of investment decision-making, with investors of diverse nationalities. These investors volunteer to challenge their strategies of allocating assets and choosing deals. It is amazing to see clients’ courage and creativity be unleashed as they challenge their preferences with regard to “Eros”, “wealth creation” and “which investment game to play.”

Now, I will guide you through two examples so that you can see how to follow the road map on your own.

Example 1. “Red Challenge”

If I am in an impulsive, egocentric mood and approach investing as a war game, I am in a “red” state of consciousness. This way of experiencing the world draws me toward investments such as machinery parks or rare paintings, opportunities that have the potential to let me experience dominance. My approach to Eros is that I long for something “impressive”.

Example 2. “Green Challenge”

If I am in a “pure and soft” mood (another Eros approach), I am likely to direct my capital into social enterprises or energy saving companies. I want to play the investment balancing game, focused on inducing social fairness and taking care of the environment.

Given the theory of spiral development, it is important to know that we investors and individuals take different routes on the road map, even daily. From personal experience evolving as an investor, I can say that the state of holistic awareness is the most fulfilling. In this state of consciousness, I desire something of a playful, self-ironic Eros experience and focus deeply on emotional wealth creation. Using the investment desire road map helps one to create identity and to be less obsessed with the desires and aims of other investment types or characters.

The “desire checklist”, as one client called it, is a sophisticated tool to overcome contradictions investors face. The pros and cons of investment decisions are protected, “hacked” or changed. You learn to play with paradoxes instead of neglecting them. For instance, in accepting the tension between the competing desires of being “playful” (see road map: Turquoise meme) and also “uncomplicated” (see road map: Blue meme), an escape to investments which unify the contradictory approaches to a “playful easiness” can lead you to previously unidentified types of portfolio companies. With this, I experienced a sort of relief. I realized that “I can have it all” as long as I don’t allow myself to be torn between “either/or”.

The road map is a tool to detect underlying motives. It encourages investors to spice up their portfolios with new, sometimes previously underestimated or unnoticed portfolio companies. By using this as an “investor’s mindset guide”, I can spot and target the next “Apple”. Furthermore, I predict that this enterprise will be in a sensual dimension.

Mariana Bozesan (1) classified my investment strategy and my quest to play with Eros as a way to take the next step in investor evolution. I feel honored to be placed in the company of those such as Whole Foods founder John Mackey. Reaching out to the impacts that create pleasure correlates to the upper left quadrant of the AQAL (all-quadrants, all-levels) model of manifest existence, conceived by Ken Wilber. By engaging Eros one welcomes sensuality into the self. It is a wonderful practice that fosters a worldview, aesthetics and directedness.

I am convinced that individual and collective investment strategies are highly influenced by two main factors: our social habits (based on the customs and traditions of the specific geographical region in which we live) and our imagination (dependent on our willingness to enhance our and others’ quality of life).The desires for sex and money govern our investment attitudes and navigate us to different kinds of portfolio companies.

The idea of the “reformed investor” is a burdening myth, – “The lonesome hero or heroine who overcomes dark desires”. Who wants to be like that? This seems a painful and self-denying approach to a courageous and creative act. Playing with contradictions –greed vs. benevolence, opulent vs. simple, technology-based vs. nature-based, small vs. big – leads investors to a new dimension of monetary creativity. We have the chance to reconcile our longing for passion with our longing for change.

Now let us continue on our journey. Once we have prepared our minds to accept paradoxes and contradiction, we are prompted to visualize new categories of desire that can trigger investing energy. In my humble opinion, this attitude towards investing perfectly fits into the acting logic of the ironist. Susanne Cook-Greuter (2) vividly describes the strengths of this state of mind in her research on ego development. Ironists can bridge contrasts and shift effortlessly their focus among many states of awareness.

I will now analyze why a new approach to luxury and pleasure liberates the search process of finding attractive portfolio companies.

Music .mp3:Joe Jackson, “Be my number two”

http://www.youtube.com/watch?v=YM5GAfknYfM

Which Kinds of Luxury and Pleasure are Rewards?

We attract what we manifest in our minds (Ken Wilber, 3).The longing for luxury and the longing for pleasure are basic human desires that hardly anyone can deny. However, in most cultures around the globe there is a rather ambivalent approach to them. When it comes to combining the “luxurious” with the “essential”, the “pleasurable” with the “meaningful”, we are torn between decadent and an ascetic attitude. Luxury and pleasure, as two characteristics of wealth, need to rid themselves of their frivolous smell. They are asking to be liberated from their coupling with decadency and carelessness.

Luxury in Transformation

“Possessing rare things in abundance” is one of the most popular and current definitions of luxury. Investing in rare things such as diamonds, arts, rare earth and precious metals or single food commodities still provides investors with a good margin for return. In addition, we see more and more funds and stocks gravitating toward the so-called lifestyle products, which sell the promise of affordable luxury. Simple consumer goods get upgraded. Apple and Burberry, as two representatives of lifestyle product producers, teach consumers how to handle a smart phone and how to wear a trench coat with pride and connoisseurship. Both types of luxury are desirable, but neither creates meaningful pleasure or essential luxury.(Uche Okonkwo and Yaffa Assouline, 4).

In improving our popular approach to luxury, a partial solution is to go for eco-luxury. Eco-luxury postulates that luxury and sustainable development share the qualities of rarity and beauty. That’s all well and good. However, most of the current products marketed under the term eco-luxury lack two Eros related benchmarks: mastership in playing a) with a combination of natural and technology based materials and b) with the tension between tradition and progress. The Eros Impact definition of essential luxury is: “Luxury is to experience the moment.“Let me present my case using examples of two different types of companies that create essential luxury. The first I call material shape shifters (using transient designs) and the second, keepers of ancient knowledge (using traditional manufacturing procedures and designs).

Example One: The Material Shape Shifters. The milk dress is an haute couture dress made of “milk fabric” and sold under the label eco-luxury. Eros Impact champions go beyond the use of natural material and a comfortable design. One division of the fashion companies in my portfolio combine natural with innovative materials and ethnic with postmodern designs. The sensorial bliss (an achievement of delight and happiness activated by the senses) in this case is satisfied by the metamorphic abilities of the materials themselves and by the endless choices of “how to dress up”. Materials and design encourage wearers to express their moods and adapt their living conditions. These products are timeless because they are designed to readily change shape, to “morph”.

Example Two: The Keepers of Ancient Knowledge. Meissen Porcelain is a type of company exhibiting this second type of Eros Impact luxury. Porcelain was created over 1,800 years ago. The German porcelain maker’s clever management team redefined the company’s purpose.They modernized the product palette, still basing it on the original manufacturing recipe invented in the 18th century. Now they incorporate home furnishing, interiors and jewelry alongside their tableware lines. Their products are timeless because the company applies ancient secrets to modernity.

Music .mp3: Marche pour la cérémonie des Turcs (J.B. Lully)

http://www.youtube.com/watch?v=grbq6AoquhI

Pleasure in Transformation

Focus now on the ‘sensual’ champions of pleasure. Aristotle already raised the question. “What ought we do when at pleasure?” A postmodern citizen of a global metropolis might answer: ”We blur the boundaries between work, duty and recreation. So, we play night and day“. Within the last ten years or so, the feeling of pleasure in its expressions of entertainment, art and wisdom has become a socially acceptable raison d’être. Johan Huizinga (5) would love to see how “generation play“ shows us that problem solving, inventing and gaming go together well. The toy and gaming industries have now become targets of alternative investments, but can they continue to create value in our pursuits of pleasure?

In many cultures we define pleasure as “an experience of constant amusement without a care.” In my opinion, our current interpretation of pleasure just leads us to more work and increasing carelessness. We have little time for real rest or relaxation. People are constantly distracted by social media and its marketplace. To make a pun, we are becoming more and more “APPsent minded”. Being “connected” comes at the cost of time. Eros suffers when so few people soulfully enjoy their leisure time.

We face the remarkable growth of fun-oriented industries, which keep consumers engaged both online and offline. The travel market is driven by unbridled adventure seeking and fueled by tourists’ services that propagate a “live now, pay later” way of life. Virtual media products, such as virtual reality goggles and GPS-equipped smart phones, are prestigious toys masterfully designed to maximize the time consumers have access to pleasure. Both examples show what it is like to experience only imitation Eros Impact, or no impact at all. I call this phenomenon “exhausting pleasure”.

Silence, recreation, and rest are key elements of the wellness industry. In addition, many of the personal care and health care markets are fueled by the sale of “lulling pleasure.” Contrary to the idea of soulful (or deep) pleasure investments, we can postulate that these “mind numbing” products and services ruin our sublime experience.

This leads me to define Eros Impact pleasure as “to switch identity”. In discovering it, I did so myself. I started in the games industry by supporting serious games. I selected mobile device gaming for people in poor developing countries as a good example. This trial investment was lacking esprit. The content of the games’ design was not respectful of regional customs and traditions and provided no freedom for users to access gaming short cuts. I asked myself, “What do investments that go beyond the services of companies like Facebook (social media) and Zynga (social games) look like?” In my investment grid, companies like Facebook and Zynga are marked as Eros hostile.

Their services only keep people busy in artificial environments but do not encourage them to be creative. Today, I support independent games on social platforms that animate users worldwide to co-create pieces of art, develop products or tell collective stories. These champions create a social connectedness that unites people in a new type of liaison. They create symbols and rituals that play unexpected and admirably with a) the attraction between cultures and b) the wisdom of generations. These companies respectfully embrace and invite the differences of social habits and cultures thereby to create a fusion between cultures (not only on the surface, but in a true fusion of practices) that brings people together. They also create an exchange that both animates and instructs old and young through a dialogue mindful of the different perspectives and ways of life between the generations. This pays off well.

Music .mp3, “Pink Martini Sunday Table”

http://www.youtube.com/watch?v=IpUOQvmW4rE

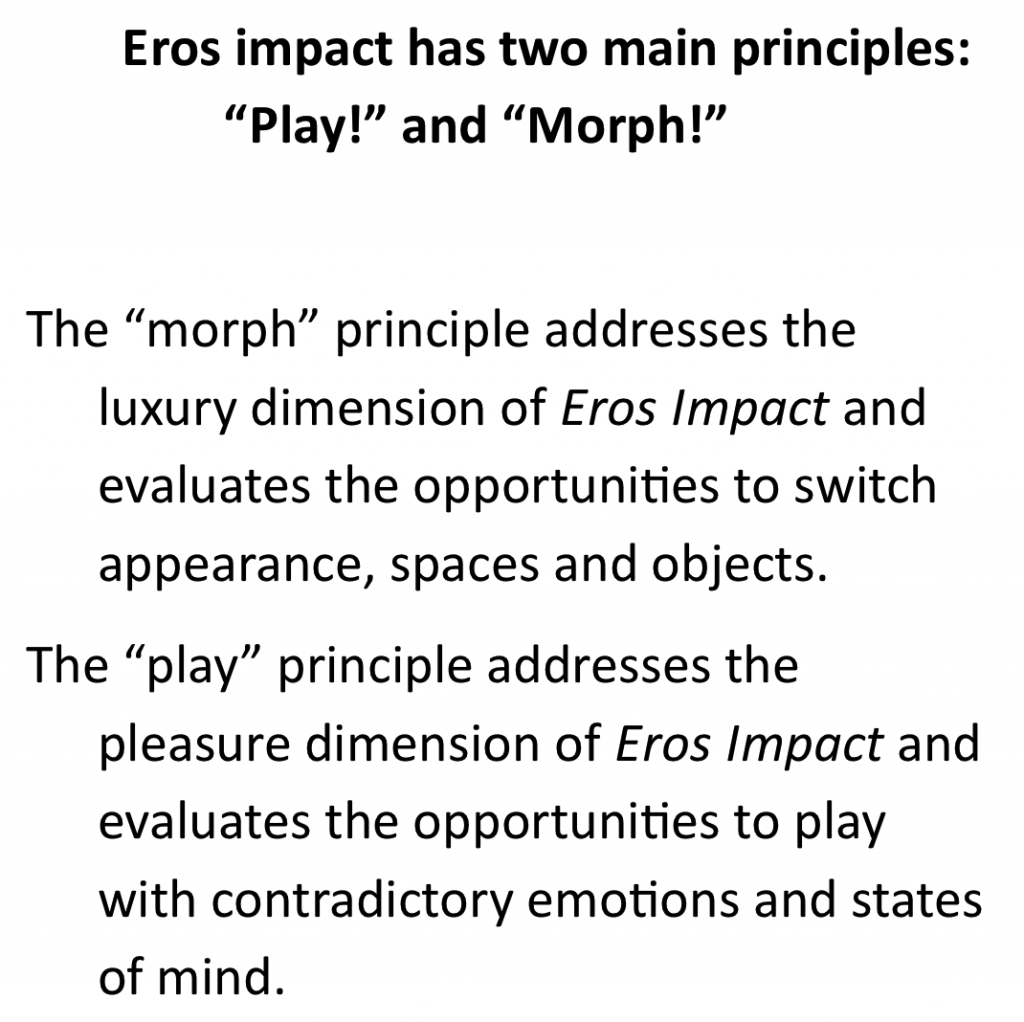

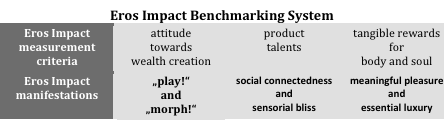

“How,” do you ask? I established a ranking system for the presence of “play and morph” abilities in portfolio companies. Companies that rank higher (“better at playing and morphing”) create more essential luxury and meaningful pleasure than their competitors. The level of sensorial bliss a product or service induces (i.e., how intensively they awaken our senses) measures essential luxury. The degree of social connectedness (similar to the intimacy one feels in personal relationships) measures meaningful pleasure. My deal searches worldwide for Eros Impact candidates with these specific abilities in mind.

This benchmarking process is in the developing stage and continues improving. Just as we value the measurements of material, social and environmental return, I am confident that in the near future we will all value those of emotional and aesthetic return.

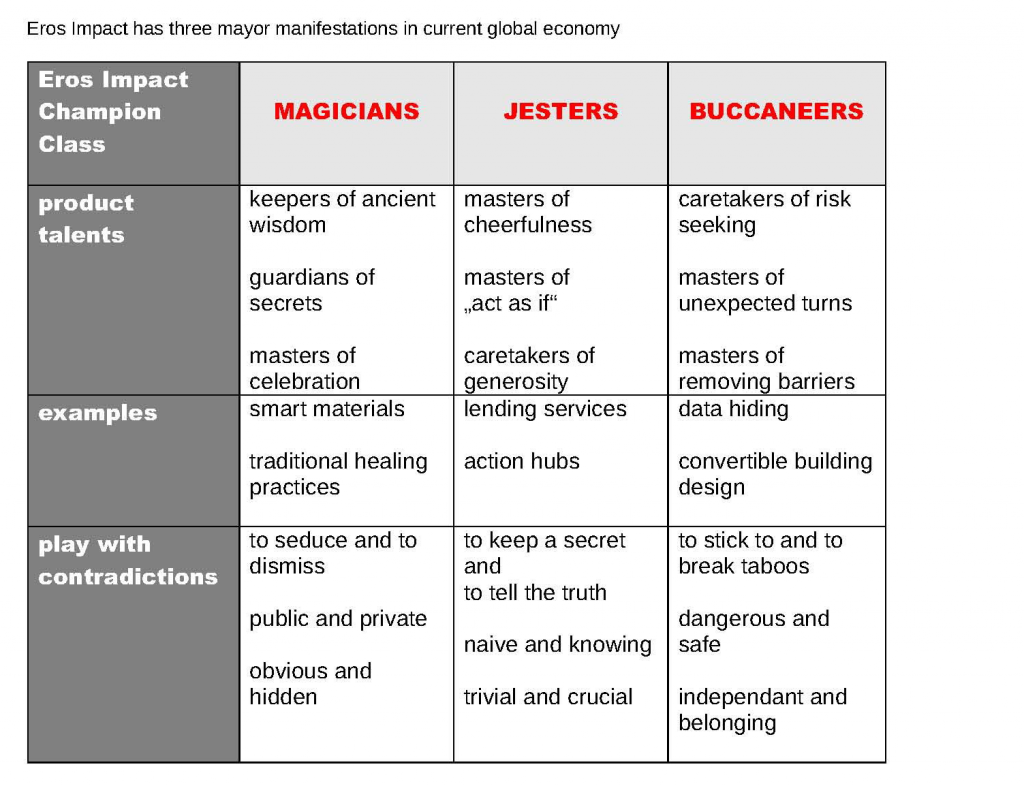

See in the next figure the summary of all Eros Impact benchmarks.

How Does Eros Impact Perform

Steve Jobs, the late CEO of Apple, demanded: ”Have taste!” Even though Mr. Jobs was not a “priest of sensuality”, his “worship” of taste can be seen as a pioneering idea that cleared the way for Eros Impact. The secret of Apple’s product innovation lies in their mastership in combining sophisticated Bauhaus-like design with easy to use technology. Today, Apple ranks, together with Exxon, at the top of the list of the most valuable companies of the 21st century. Since Apple had its triumphal march in the stock markets, we have experienced how trust in products that couple functionality and beauty create high financial returns.

Classifying different characteristics of Eros Impact facilitates to define a portfolio company’s added value. There are three manifestations of today’s Best-in-Class Eros Impact directed companies: the magicians, the buccaneers and the jesters. I will guide you now in recognizing their investment potential in terms of material and emotional wealth creation.

Music .mp3, Kings of Leon, “Beach Side”

http://www.youtube.com/watch?v=iwbTjV6055A

Ventures Wanted: Eros Impact Champions Who Are Magicians

Figuratively speaking, Eros longs for mystery. He is a master of playing with secrets and of creating riddles and ways to solve them. I see representative examples of this ability in two business sectors, smart materials and ancient healing practices.

First example: Think of the groundbreaking flexible design of Frank Gehry`s Las Vegas Clinic. The “smart materials” involved come from both natural and technological origins. Some of my favorite companies are the ones with materials that can change shape, color and aggregate state. These kinds of materials are taking the fashion, housing, personal and health care industries by storm because they allow consumers to see the world as their playground. In the hands of artists and designers these materials are problem solvers and suppliers of joy.

Second example: Think of companies that preserve ancient knowledge like Ayurveda, Hildegard von Bingen or Traditional Chinese Medicine. Rather than just preserving that knowledge, they grow and refine herbal remedies and transfer ancient healing practices to modern demands. They are treasure keepers of invaluable assets. MAGICIANS are the first group of desirable ventures in my portfolio.

Ventures Wanted: Eros Impact Champions Who Are Buccaneers

Eros is a master of reconciling paradoxes and of the game of “hide and seek”.We see him either pursue and unite or ignore all together certain contradictions such as “the wealthy and the poor”, “the easy and the complicated “or “the beautiful and the ugly”.He goes beyond restrictions and limits.

How do Buccaneers manifest in the economy? An example: Inventive entrepreneurs put the security industry to the test. Their enterprises redefine “safeness” when it comes to personal safety, data security and protection of our possessions. Instead of creating fortresses such as firewalls and smart home technologies, they protect your privacy by hiding you and your information. I must admit, my money is attracted by Buccaneers.

Ventures Wanted: Eros Impact Champions Who Are Jesters

Eros approaches every opportunity with a humorous spirit. In business terms, he lures us to mock the concept of traditional efficiency and rational decision-making.

First example: Lending services maximize their potential for diversification by subverting the need for capital and functioning on the premise that you don’t need to possess things, just borrow them for a specific occasion or period of time to produce the desired effect – similarly to how you would borrow the punch-line of a “blonde joke”. Whether luxury brand items, electricity or furniture, products are in actuality only tools of a service that sells.

Second example: “Action hubs” create new “tribes”, partnerships and neighborhoods. Their clients willingly unite across geographical regions and amongst social statuses. This service goes beyond collaborative consumption. It creates new value rather than exhausting, or just sharing, a given parameter or resource. The driving force is co-creating, done so with a joyful mutual understanding. (“We know how to create abundance.”) Lending services and action hubs are hotbeds of Eros Impact. That is why I call this category of attractive portfolio companies Jesters.

Hopefully, these examples have whetted your appetite to discover how to apply Eros Impact.

How to Utilize Eros Impact?

Eros Impact motivates investors to re-connect to emotional, aesthetic and cultural longings. It trains us to ask: Does the property we buy have charm? Do the industrial and virtual infrastructures we support attract cultural exchange? Are the consumer brand names we invest in really the ones we want to see in the streets? Eros Impact enters the ring with its credo: “Wealth creation must be ingenious and lush.”

When I see Eros Impact already at service with innovative investors, it makes me smile. With Eros Impact, traditional investors experience the satisfaction that lies in protecting and encouraging the diversity and variety of commodities. In their for profit investments, philanthropists enjoy the same inspiration they experience from supporting culture and education. I see high tech and clean tech investors benefit from the increased value by which arts make technology and science “fertile”. Additionally, I see social impact investors who erase poverty while encouraging joy. What do all of us pioneering investors have in common? We sensualize our portfolios!

Sensualness has a high aesthetic value. Without joyful aesthetics, we live in a sterile world. My fellow investors and I share the desire to buy or hold investments that encourage the expression of Eros in material and design. We avoid investing in products that waste time and energy and absorb users from experiencing their joys and passions.

Music .mp3 Pink Floyd, “Comfortably numb”

http://www.youtube.com/watch?v=iSR9-43-z9o

A Daring Prognosis

“To be happy you must have taken the measure of your powers, tasted the fruits of your passion, and learned your place in the world.” ― George Santayana (7)

In our lifetimes, we will see the rise of a sensual economy. Business sectors and industries that celebrate a “lust for life” will revolutionize global wealth creation in material and spiritual dimensions. Investors who are dedicated to couple arts and sciences and who enjoy playing with the tension between tradition and progress will establish sensuality as a basic object of desire for investing.

Three groups of skilled players are already on their way to making this change happen:

(1.) Entrepreneurs, top dogs and newcomers who battle monotony and wastefulness. Their products are masters of “play” and “morph”.

(2.) Investors, institutional and individual, who use money as an artistic tool. Their short-term and long-term investments improve what we as humans connect with pleasure and luxury.

(3.) Financial advisers, independent or within the traditional banking system, who improve risk mitigation. Their financial products and due diligence procedures use Eros Impact benchmarks to define returns on investment.

Eros Impact as an investment strategy responds elegantly to a dramatic conflict:

The investment world experiences a new wave of culture clash.

The “centers of global wealth identification” shift. For many decades Western Europe and the USA have been the leaders in defining what wealth is. The competition between the moral concepts of “less is more” (currently a more Western attitude) and “show what you have“ (currently a more Eastern attitude) shows how we struggle to decide what is worth to keep and what is ready to be let go (Global Wealth Report 2011 [6]). With the financial success of new centers of global wealth creation such as China, India and Brazil, prosperity and wealth are being redefined. The rise of unique national brands from the BRICK states shows that we are collectively experiencing a change in what it is desirable to possess.

It’s clear to me that we investors can influence how industries and products connect people. We have a say in a cultural dimension. With this mindset our frame of investments shapes an economy that determines the kinds of things we consumers desire and which kinds of relationships we seek. Being an influenter of sensualness, you let your investments elegantly connect, not only people themselves, but also all aspects of their lives –for example, entertainment and healthcare industries (into hospitals designed like a fairground) or arts and housing (into video and audio walls that provide noise protection and video and audio delights). With our human imagination there are endless possibilities; the sky’s the limit. Imagine the possibilities and delight (along with prosperity and wealth) that could be created if the aspects of our every day lives were connected to each other, creating, for example, “mobile healthcare” and “healthy mobility”, “intelligent beauty” and “beautiful knowledge”

Eros Impact encourages and protects the prosperity of cultural diversity, because it is sensitive the essence of essential luxury and meaningful pleasure. Aware of the different stages of economic growth and cultural development across the globe, the strategy suppresses the dominance of a single cultural worldview in deal selection. In addition, Eros Impact contributes to managing the cultural clash by directing investments to please our collective human sense of beauty and our love for affection. The strategy is therefore a safeguard in finding portfolio companies that are powerful representatives of sensual global wealth creation.

By focusing on Eros Impact, we devote ourselves to creating identity and progress in our investments. That is what I call investors’ evolution at its best. Then, Capital is in Love.

Patricia von Papstein is a private investor from Europe who backs for a win of Eros Impact. Subscribe to her blog, www.capitalinlove.com, where she writes about the pleasures and drawbacks of sensual wealth creation.

Contact e-mail: vonpapstein@capitalinlove.com

About the Co-contributors

Jagshinder Kaur (Mumbai, India), Suza Schlecht (Cologne, Germany) and Rüdiger Wassibauer (Salzburg, Austria) support Patricia as deal scouts. They classify and select financial products and portfolio companies according to Eros Impact benchmarks.

Recommended Reading

Mariana Bozesan, M. (2012). “Demystifying the Future of Investing, Part 1 & 2: An Investor’s Perspective. Journal of Integral Theory and Practice. (Vol. 7, No. 4).

Credit Suisse Global Wealth Report (2011). https://infocus.creditsuisse.com/data/_product_documents/_shop/291481/credit_suisse_global_wealth_report.pdf

Cook-Greuter, Susanne R. (2011).Postautonomous Ego Development: – A Study of its Nature and Measurement, Tucson AZ: Integral Publishers.

Johan Huizinga, (1955). Homo Ludens: A Study of the Play Element in Culture. Boston: Beacon Press.

George Santayana (2003). The Sense of Beauty, originally published 1896, Piscataway, New Jersey: Transaction Publisher.

Uche Okonkwo and Yaffa Assouline, (2011). Luxury Now: Evolution, Status, Future. New York: Palgrave, 2011.

Ken Wilber (2000). “Right Bucks”. http://www.kenwilber.com/Writings/PDF/RightBucks_GENERAL_b42000.pdf.